Florida-Based Financial Service Company Uses Twilio-Powered Call Management to Help Consumers Overcome Debt

A financial service company in Florida empowers consumers to tackle debt through an efficient Twilio-powered call management system.

A Florida-based Financial Service Company focused on helping consumers overcome debt and work toward a brighter financial future sought to enhance its customer service by improving call center operations.

Inbound Call Handling with Twilio

The company’s support center needed an efficient way to manage high volumes of inbound calls from customers seeking help with debt consolidation, payment plan inquiries, and financial advice.

Scenario:

A customer calls in to request information about restructuring their payment plan. The call is routed through Twilio’s Programmable Voice API and IVR system, which offers options such as speaking with an agent, checking account balance, or learning about financial aid programs.

Twilio Integration:

TaskRouter dynamically routes the call to the best available agent based on skill set (debt restructuring expertise) and availability.

Result:

The customer receives timely and accurate support, reducing wait times and ensuring that they can manage their financial situation effectively.

Outbound Call Management

Scenario:

A financial counselor needs to follow up with a customer about an overdue payment. Using Twilio’s API, the system schedules the call at a convenient time for both the agent and the customer.

Twilio Integration:

Result:

Call Merging for Collaborative Consultations

Some customers require consultations with multiple parties, such as financial advisors and legal experts, to discuss complex debt resolution options.

Scenario:

Twilio’s conferencing feature allows agents to seamlessly merge calls between departments or external stakeholders, enabling real-time collaboration on critical financial decisions.

Twilio Integration:

TaskRouter dynamically routes the call to the best available agent based on skill set (debt restructuring expertise) and availability.

Result:

The customer benefits from a collaborative discussion, receiving advice from multiple experts in one call, which helps streamline the debt resolution process.

Call Barging for Real-Time Support

Supervisors can monitor calls and “barge” in to provide support when agents are dealing with complex or challenging customer interactions.

Scenario:

Twilio Integration:

Result:

The supervisor’s intervention helps resolve the issue more efficiently, boosting customer satisfaction and agent confidence.

Call Recording for Compliance and Training

In the financial services industry, it’s critical to record calls for compliance and training purposes, especially when handling sensitive debt-related discussions.

Scenario:

Twilio Integration:

All calls are automatically recorded and securely stored using Twilio’s platform, allowing the company to review interactions for compliance and quality control.

Result:

The company remains compliant with industry regulations while also using recordings to train agents on best practices in debt management counseling.

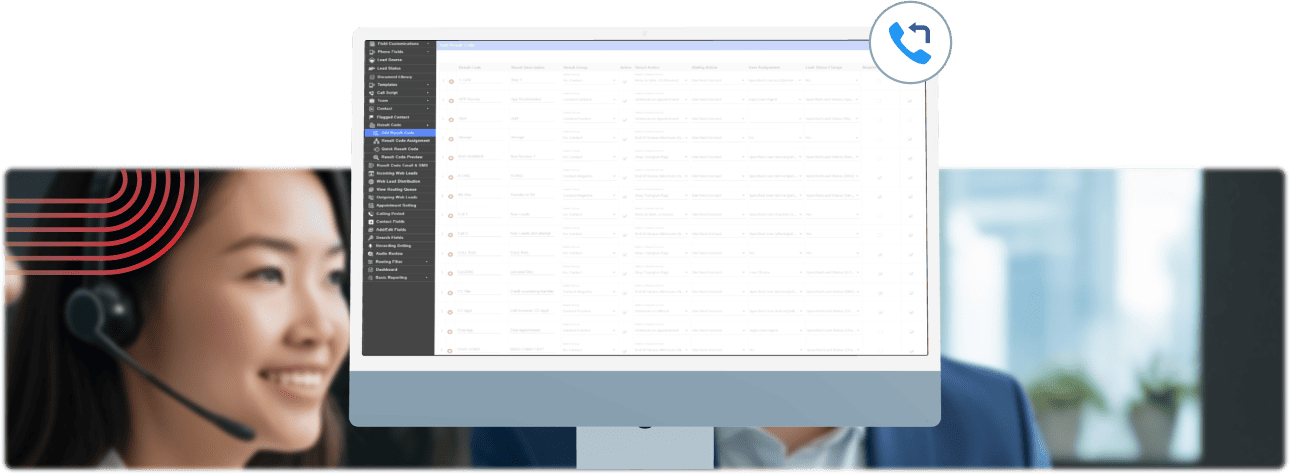

TaskRouter for Agent Availability, Skill Set, and Call Priority

Twilio’s TaskRouter allows the company to route calls based on agent expertise and call priority, ensuring that complex financial cases are handled by the most qualified staff.

Scenario:

A high-priority customer with a large debt case calls in for support. TaskRouter prioritizes the call and routes it to an agent specialized in high-value debt settlements.

Twilio Integration:

TaskRouter assigns calls based on agent availability, expertise in debt counseling, and the urgency of the customer’s case, ensuring that high-priority calls receive immediate attention.

Result:

High-priority cases are resolved more quickly, improving customer outcomes and increasing the company’s efficiency.

Call Forwarding for Uninterrupted Service

The company ensures that calls are not missed by using Twilio’s call forwarding feature, directing unanswered calls to available agents or mobile numbers.

Scenario:

A customer calls in after hours to inquire about payment options. The system forwards the call to an agent on standby or routes it to a mobile number for assistance.

Twilio Integration:

Twilio’s call forwarding ensures that calls are automatically rerouted to available agents or backup teams, preventing missed opportunities to assist customers.

Result:

Customers receive support even outside of regular business hours, ensuring uninterrupted service.

Missed Call Notifications

When customers miss important outbound calls, the system sends automatic notifications to remind them to follow up.

Scenario:

A customer misses a call about an overdue payment. Twilio’s SMS API sends an automated text message notifying the customer of the missed call and offering a callback option.

Twilio Integration:

Twilio’s SMS feature sends real-time notifications, ensuring that customers are aware of missed calls and can promptly reconnect with support.

Result:

Customers stay informed about important updates, leading to fewer missed payments and improved communication with the financial service team.

Callback Options for Convenience

During peak hours, customers can request a callback rather than waiting in a queue, ensuring they receive attention at their convenience.

Scenario:

Twilio Integration:

Result:

Outcome

Increased Efficiency

Intelligent routing and call management ensured that agents handled inquiries quickly and effectively, reducing wait times and improving first-call resolution rates.

Compliance and Security

Call recording, compliance features, and secure communication tools ensured that the company met financial regulations and protected sensitive customer data.

Improved Customer Satisfaction

Features such as call forwarding, missed call notifications, and callback options enhanced the customer experience, keeping clients engaged and reducing frustration.

Scalability

With Twilio’s cloud-based communication system, the company scaled its operations efficiently to handle increasing call volumes without sacrificing service quality.

This Twilio-powered call management system allowed the company to enhance its customer service operations, helping clients navigate debt management more effectively while ensuring regulatory compliance and operational efficiency.

Twilio Powered Call Center Transformation for Financial Services

Business Challenge

- High inbound call volumes related to debt consolidation and payment plans

- Manual call routing leading to long wait times

- Limited visibility into agent availability and skill-based assignment

- Compliance risks due to inadequate call recording and monitoring

- Inefficient follow-ups for overdue payments

- Missed calls and poor after-hours coverage

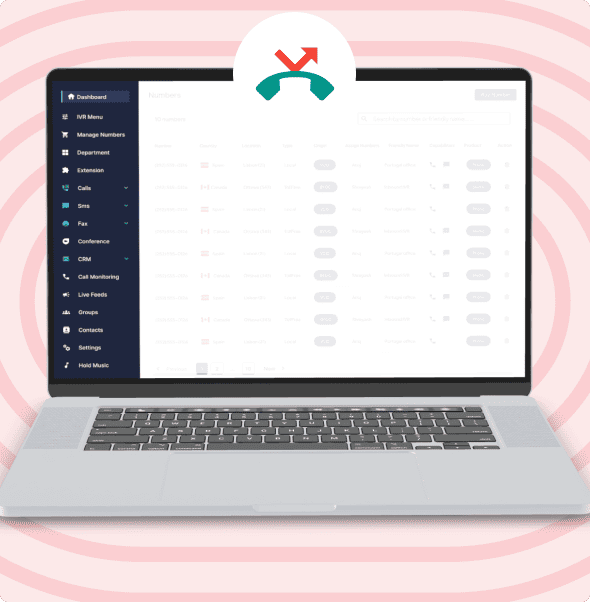

Solution Overview: Salesforce–Twilio CTI Integration

Unified Call Management

Intelligent Call Routing

Real-Time Collaboration & Monitoring

Compliance-Ready Communication

Inbound Call Handling with Twilio

How it works

Calls are routed through Twilio Programmable Voice and IVR menus, allowing customers to select relevant options such as account queries or speaking with a financial advisor.

Salesforce & Twilio Integration

Impact

- Reduced wait times

- Faster first-call resolution

- Accurate support from qualified agents

Outbound Call Management

How it works

Salesforce & Twilio Integration

Impact

- Reduced wait times

- Accurate support from qualified agents

Call Merging & Conferencing

Capability

Impact

Supervisor Call Barging & Monitoring

Supervisors can listen to live calls and intervene when necessary.

Capability

Impact

Call Recording & Intelligent Routing

Compliance & Operational Impact

Continuous Call Coverage & Engagement

Continuity

Convenience

Agile Delivery Process

Sprints

Feedback

Releases

Velocity

Quality Assurance (QA) Process

Integration

Functionality

Performance

Security

Results & Business Impact

Call Handling Time

Platform uptime

Sign completion

Sign completion

Frequently asked questions

Why integrate Twilio with Salesforce CTI?

Is Twilio CTI suitable for financial services compliance?

Can the solution scale with business growth?

Ready to Transform Your Call Center Operations?

Have an Idea ?

(*) Asterisk denotes mandatory fields

Success Stories