Table of content

Introduction

The Auto Components Industry Landscape

Challenges in Aligning Sales & Production

How Salesforce Manufacturing Cloud Aligns Sales & Production

Case Study: Auto Parts Supplier Alignment with Salesforce

The Future of Sales–Production Alignment in Auto Parts

Conclusion

Introduction

The auto parts and components industry is the backbone of global automotive production, supplying everything from engines and transmissions to chips and sensors. According to IBISWorld, the global auto parts manufacturing market will reach $2.3 trillion by 2026, yet margins remain thin and competition intense.

For suppliers, the biggest challenge is aligning sales demand from OEMs with production capacity. Overproduction ties up capital, while underproduction strains relationships and risks penalties. Traditional CRMs and ERPs often fail to synchronize sales agreements with real-time production planning.

Salesforce Manufacturing Cloud bridges this gap, enabling suppliers to forecast accurately, align production schedules with OEM commitments, and gain end-to-end visibility across sales and operations.

The Auto Components Industry Landscape

Auto component manufacturers supply:

- OEMs (original equipment manufacturers) like GM, Toyota, Tesla

- Tier-1 suppliers (engines, batteries, electronics)

- Tier-2 and Tier-3 suppliers (fasteners, sensors, plastics, interior parts)

Key pressures include:

- Short product cycles driven by EVs and advanced driver assistance systems (ADAS).

- Cost pressure from OEMs, demanding just-in-time delivery.

- Globalized supply chains with high logistics dependencies.

- Regulatory compliance (e.g., carbon neutrality, safety standards).

? Without tight alignment of sales and production, suppliers risk missed deadlines, lost contracts, and reduced profitability.

Challenges in Aligning Sales & Production

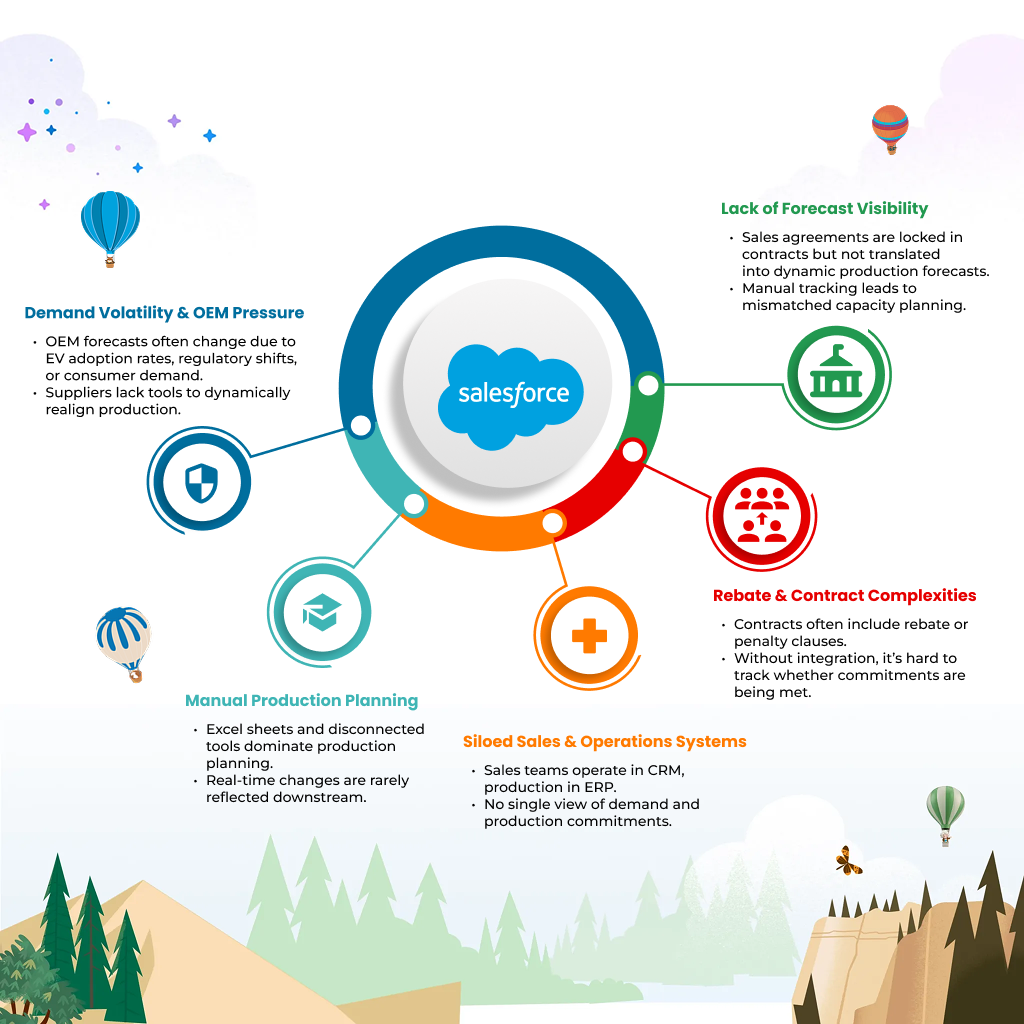

1. Demand Volatility & OEM Pressure

- OEM forecasts often change due to EV adoption rates, regulatory shifts, or consumer demand.

- Suppliers lack tools to dynamically realign production.

2. Lack of Forecast Visibility

- Sales agreements are locked in contracts but not translated into dynamic production forecasts.

- Manual tracking leads to mismatched capacity planning.

3. Manual Production Planning

- Excel sheets and disconnected tools dominate production planning.

- Real-time changes are rarely reflected downstream.

4. Siloed Sales & Operations Systems

- Sales teams operate in CRM, production in ERP.

- No single view of demand and production commitments.

5. Rebate & Contract Complexities

- Contracts often include rebate or penalty clauses.

- Without integration, it’s hard to track whether commitments are being met.

How Salesforce Manufacturing Cloud Aligns Sales & Production

1. Sales Agreements → Linking Commitments with Production Plans

- Store OEM sales agreements directly in Salesforce.

- Provide a shared view of commitments to both sales and production teams.

- Align revenue goals with production schedules.

2. Account-Based Forecasting → Demand Visibility at the Component Level

- Breaks down forecasts by OEM account, region, and product line.

- Tracks OEM commitments vs. actual orders.

- Helps suppliers prioritize critical components (e.g., semiconductors, EV batteries).

3. ERP Integration → Bridging Sales and Operations

- Syncs Salesforce with ERP systems (SAP, Oracle, SYSPRO).

- Production planners see real-time demand inputs.

- Finance teams align revenue recognition with production schedules.

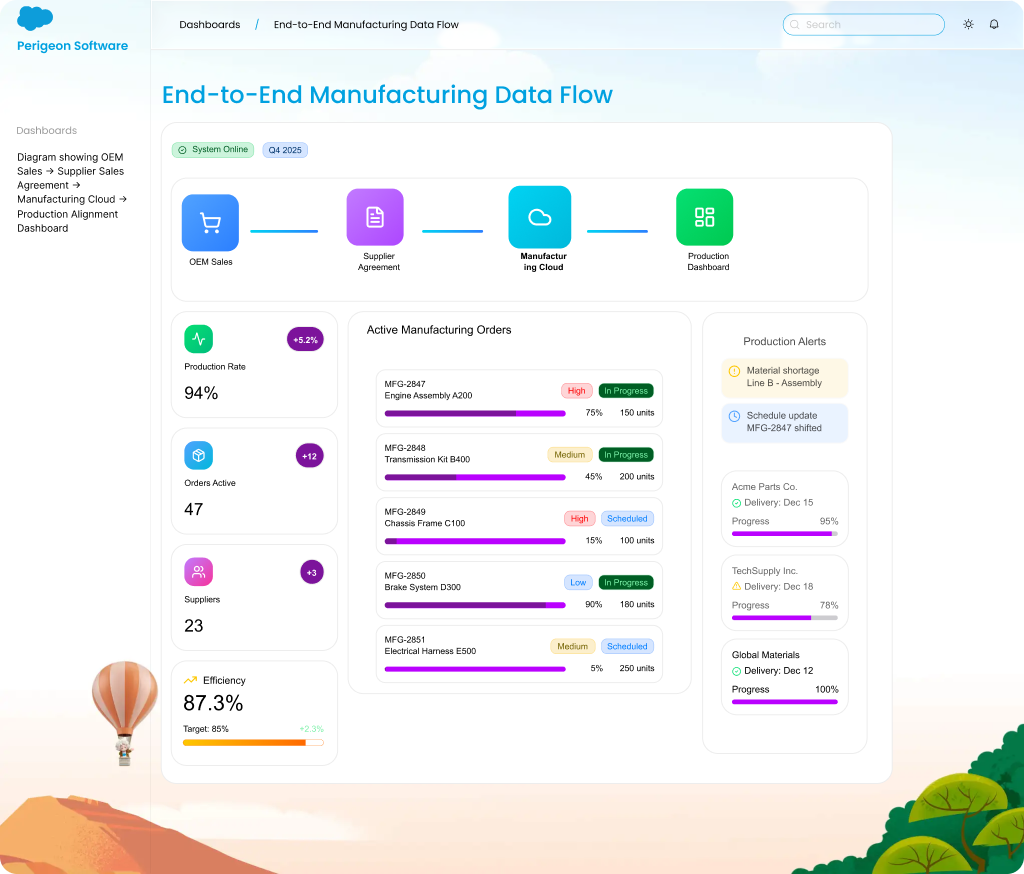

4. Production Planning Dashboards → Real-Time Adjustments

- Salesforce dashboards show:

- OEM commitments vs. actuals

- Production status by plant

- Backlogs and bottlenecks

- Managers can adjust production capacity dynamically.

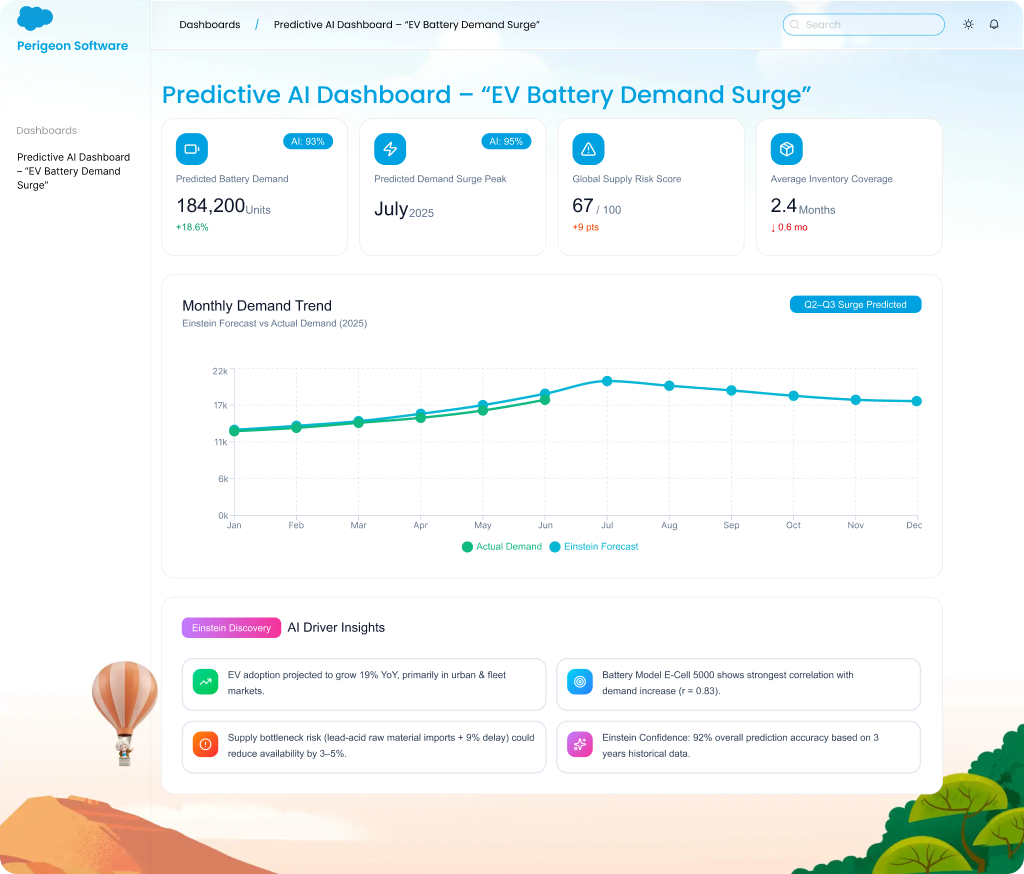

5. AI-Powered Insights → Predictive Demand Shaping

- Einstein AI analyzes:

- OEM buying patterns

- Regional adoption rates

- Macroeconomic shifts

- Suggests production realignment proactively.

? Example: If an EV OEM suddenly scales up, AI alerts suppliers to shift battery production capacity.

Case Study: Auto Parts Supplier Alignment with Salesforce

A Tier-1 battery supplier faced:

-

- Forecast deviations of 30% with multiple OEMs.

- Frequent penalty payments for missed delivery timelines.

After implementing Manufacturing Cloud:

- Forecast deviation dropped to under 10% in one year.

- Production efficiency improved by 18%, reducing costs.

- OEM satisfaction improved due to on-time delivery guarantees.

The Future of Sales–Production Alignment in Auto Parts

The next decade will see:

- Digital Twins aligning production simulations with demand forecasts.

- IoT sensors in plants feeding data into Salesforce for real-time visibility.

- AI-driven capacity optimization, predicting bottlenecks before they occur.

- Blockchain-enabled contracts, ensuring OEM and supplier commitments are traceable and tamper-proof.

According to BCG, suppliers that integrate forecasting and production digitally can achieve 10–15% higher EBITDA margins.

Conclusion

Aligning sales and production in auto parts manufacturing is no longer optional — it is the key to profitability and competitiveness. Salesforce Manufacturing

- Translate OEM sales agreements into production plans

- Improve forecast accuracy at the account level

- Bridge CRM and ERP for unified visibility

- Adjust production in real time using AI insights

For suppliers navigating the EV transition, supply chain risks, and OEM pressure, Salesforce provides the end-to-end alignment needed to thrive.

? Ready to align your sales and production with confidence?

? [Book a Manufacturing Cloud Strategy Session with Perigeon]